Page 290 - SAMRC Annual Report 2024-2025

P. 290

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

SIGNIFICANT ACCOUNTING POLICIES

(CONTINUED)

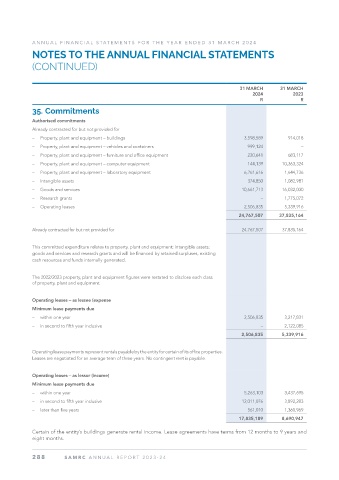

1.17 Commitments

Items are classified as commitments when an entity has committed itself to future transactions that will

normally result in the outflow of cash.

Commitments for which disclosure is necessary to achieve a fair presentation is disclosed in a note to the

financial statements, if both the following criteria are met:

• Contracts should be non-cancelable or only cancelable at significant cost (for example, contracts for

computer or building maintenance services); and

• Contracts should relate to something other than the routine, steady, state business of the entity –

therefore salary commitments relating to employment contracts commitments are excluded.

1.18 Revenue from exchange transactions

Revenue is the gross inflow of economic benefits or service potential during the reporting period when

those inflows result in an increase in net assets, other than increases relating to contributions from owners.

An exchange transaction is one in which the entity receives assets or services, or has liabilities

extinguished, and directly gives approximately equal value (primarily in the form of goods, services or

use of assets) to the other party in exchange.

Fair value is the amount for which an asset could be exchanged, or a liability settled, between

knowledgeable, willing parties in an arm’s length transaction.

Measurement

Revenue is measured at the fair value of the consideration received or receivable.

Sale of goods

Revenue from the sale of goods is recognised when all the following conditions have been satisfied:

• the entity has transferred to the purchaser the significant risks and rewards of ownership of the goods;

• the entity retains neither continuing managerial involvement to the degree usually associated with

ownership nor effective control over the goods sold;

• the amount of revenue can be measured reliably;

• it is probable that the economic benefits or service potential associated with the transaction will flow

to the entity; and

• the costs incurred or to be incurred in respect of the transaction can be measured reliably.

Revenue derived from the sale of animal blood; dietary assessment kits and nutritional textbooks and

sale of biological assets are classified as sale of goods.

Rendering of services

When the outcome of a transaction involving the rendering of services can be estimated reliably, revenue

associated with the transaction is recognised by reference to the stage of completion of the transaction

at the reporting date. The outcome of a transaction can be estimated reliably when all the following

conditions are satisfied:

• the amount of revenue can be measured reliably;

• it is probable that the economic benefits or service potential associated with the transaction will flow to

the entity;

• the stage of completion of the transaction at the reporting date can be measured reliably; and

• the costs incurred for the transaction and the costs to complete the transaction can be measured reliably.

288 SAMRC ANNUAL REPOR T 2025-26