Page 338 - SAMRC Annual Report 2024-2025

P. 338

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

49. Risk management (continued)

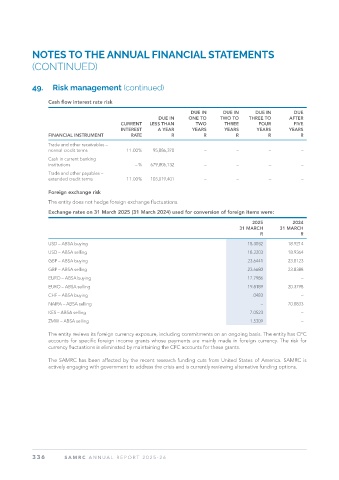

Cash flow interest rate risk

DUE IN DUE IN DUE IN DUE

DUE IN ONE TO TWO TO THREE TO AFTER

CURRENT LESS THAN TWO THREE FOUR FIVE

INTEREST A YEAR YEARS YEARS YEARS YEARS

FINANCIAL INSTRUMENT RATE R R R R R

Trade and other receivables –

normal credit terms 11.00% 95,886,370 – – – –

Cash in current banking

institutions – % 679,806,132 – – – –

Trade and other payables –

extended credit terms 11.00% 103,019,401 – – – –

Foreign exchange risk

The entity does not hedge foreign exchange fluctuations.

Exchange rates on 31 March 2025 (31 March 2024) used for conversion of foreign items were:

2025 2024

31 MARCH 31 MARCH

R R

USD – ABSA buying 18.3032 18.9214

USD – ABSA selling 18.3203 18.9364

GBP – ABSA buying 23.6441 23.8123

GBP – ABSA selling 23.6680 23.8388

EURO – ABSA buying 17.7986 –

EURO – ABSA selling 19.8189 20.3798

CHF – ABSA buying .0483 –

NAIRA – ABSA selling – 70.8833

KES – ABSA selling 7.0523 –

ZMW – ABSA selling 1.5309 –

The entity reviews its foreign currency exposure, including commitments on an ongoing basis. The entity has CFC

accounts for specific foreign income grants whose payments are mainly made in foreign currency. The risk for

currency fluctuations is eliminated by maintaining the CFC accounts for these grants.

The SAMRC has been affected by the recent research funding cuts from United States of America. SAMRC is

actively engaging with government to address the crisis and is currently reviewing alternative funding options.

336 SAMRC ANNUAL REPOR T 2025-26