Page 50 - SAMRC Strategic Plan

P. 50

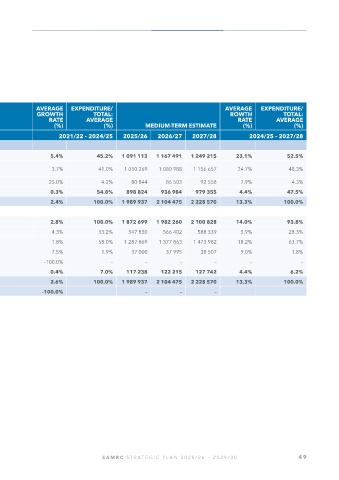

13. Financial Performance: ENE Summary

AVERAGE EXPENDITURE/ AVERAGE EXPENDITURE/

GROWTH TOTAL: ROWTH TOTAL:

STATEMENT OF AUDITED AUDITED AUDITED APPROVED RATE AVERAGE RATE AVERAGE

FINANCIAL PERFOMANCE OUTCOME OUTCOME OUTCOME BUDGET (%) (%) MEDIUM-TERM ESTIMATE (%) (%)

R THOUSAND 2021/22 2022/23 2023/24 2024/25 2021/22 – 2024/25 2025/26 2026/27 2027/28 2024/25 – 2027/28

REVENUE

Non-tax revenue 572 367 663 950 770 497 670 486 5.4% 45.2% 1 091 113 1 167 491 1 249 215 23.1% 52.5%

Sale of goods and services other 3.7% 41.0% 1 010 269 1 080 988 1 156 657 24.7% 48.3%

than capital assets 534 672 600 035 693 051 596 827

Other non-tax revenue 37 695 63 915 77 446 73 659 25.0% 4.2% 80 844 86 503 92 558 7.9% 4.3%

Transfers received 851 066 778 854 746 554 859 833 0.3% 54.8% 898 824 936 984 979 355 4.4% 47.5%

Total revenue 1 423 433 1 442 804 1 517 051 1 530 319 2.4% 100.0% 1 989 937 2 104 475 2 228 570 13.3% 100.0%

Expenses

Current expenses 1 306 405 1 333 669 1 452 277 1 417 938 2.8% 100.0% 1 872 699 1 982 260 2 100 828 14.0% 93.8%

Compensation of employees 436 775 484 064 551 948 495 270 4.3% 33.2% 547 830 566 402 588 339 5.9% 28.3%

Goods and services 845 490 824 546 867 307 892 918 1.8% 58.0% 1 287 869 1 377 863 1 473 982 18.2% 63.7%

Depreciation 23 936 24 835 32 650 29 750 7.5% 1.9% 37 000 37 995 38 507 9.0% 1.8%

Interest, dividends and rent on land 204 224 372 – -100.0% – – – – – –

Transfers and subsidies 111 007 101 590 86 141 112 381 0.4% 7.0% 117 238 122 215 127 742 4.4% 6.2%

TOTAL EXPENSES 1 417 412 1 435 259 1 538 418 1 530 319 2.6% 100.0% 1 989 937 2 104 475 2 228 570 13.3% 100.0%

SURPLUS/(DEFICIT) 6 021 7 545 (21 367) – -100.0% – – –

SAMRC STRATEGIC PLAN 2025/26 – 2029/30 49