Page 274 - SAMRC Annual Report 2024-2025

P. 274

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

SIGNIFICANT ACCOUNTING POLICIES

(CONTINUED)

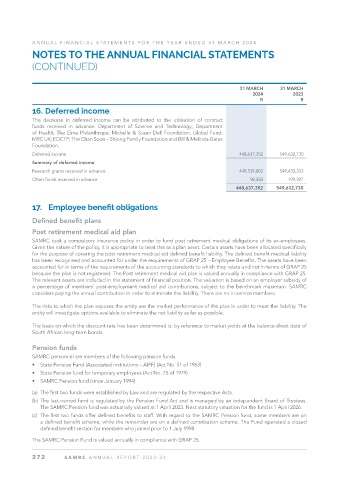

1.5 Property, plant and equipment (continued)

The entity identified the following major components of furniture and office equipment as furniture and

office equipment and signage.

Property, plant and equipment is carried at cost less accumulated depreciation and any impairment losses.

Property, plant and equipment are depreciated on the straight line basis over their expected useful lives

to their estimated residual value.

The useful lives of items of property, plant and equipment have been assessed as follows:

ITEM DEPRECIATION METHOD AVERAGE USEFUL LIFE

Land (including boreholes) Not depreciated Indefinite

Buildings Straight line 40 – 50 years

Vehicles and containers Straight line 5 – 10 years

Furniture and office equipment Straight line 3 – 15 years

Computer equipment Straight line 5 – 10 years

Generators Straight line 20 – 30 years

Borehole tanks and pumps Straight line 10 – 15 years

Air conditioners Straight line 10 – 15 years

Irrigation equipment Straight line 10 – 15 years

Signage Straight line 10 – 15 years

Prefabricated buildings Straight line 20 – 30 years

Water pipes Straight line 20 – 30 years

Water meters Straight line 10 – 15 years

Laboratory equipment Straight line 5 – 30 years

The items listed above are grouped in land; buildings; vehicles and containers; furniture and office

equipment; computer equipment and laboratory equipment classes.

The residual value, the useful life and depreciation method of each asset is reviewed at the end of each

reporting date. If the expectations differ from previous estimates, the change is accounted for as a

change in accounting estimate. The useful lives of assets are based on management’s estimation. The

actual useful lives of assets and residual values are assessed annually and may vary depending on a

number of factors. In re-assessing asset useful lives, factors such as technology, innovation, product life

cycles and maintenance programmes are taken into account. The estimation of residual values of assets

determines whether they will be sold or used to the end of their useful lives and what their condition

would be like at that time. Residual value assessments consider issues such as, the remaining life of the

asset and the estimated amount which the entity would currently obtain.

Each part of an item of property, plant and equipment with a cost that is significant in relation to the total

cost of the item is depreciated separately.

The depreciation charge for each period is recognised in surplus or deficit unless it is included in the

carrying amount of another asset.

Items of property, plant and equipment are derecognised when the asset is disposed of or when there

are no further economic benefits or service potential expected from the use of the asset.

272 SAMRC ANNUAL REPOR T 2025-26