Page 325 - SAMRC Annual Report 2024-2025

P. 325

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

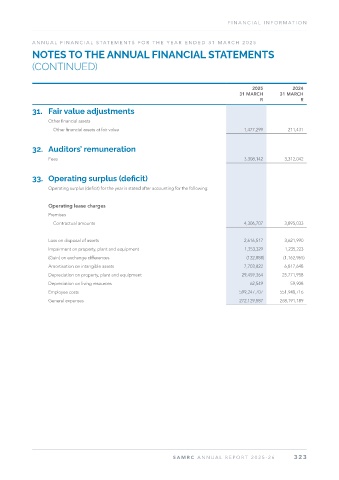

31. Fair value adjustments

Other financial assets

Other financial assets at fair value 1,477,299 211,431

32. Auditors’ remuneration

Fees 3,308,142 3,312,042

33. Operating surplus (deficit)

Operating surplus (deficit) for the year is stated after accounting for the following:

Operating lease charges

Premises

Contractual amounts 4,306,707 3,895,033

Loss on disposal of assets 2,616,517 3,621,990

Impairment on property, plant and equipment 1,353,329 1,235,223

(Gain) on exchange differences (122,888) (1,162,965)

Amortisation on intangible assets 7,703,822 6,817,648

Depreciation on property, plant and equipment 29,459,364 25,771,958

Depreciation on living resources 62,549 59,908

Employee costs 599,247,707 551,948,716

General expenses 272,129,587 268,191,189

SAMRC ANNUAL REPOR T 2025-26 323