Page 328 - SAMRC Annual Report 2024-2025

P. 328

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

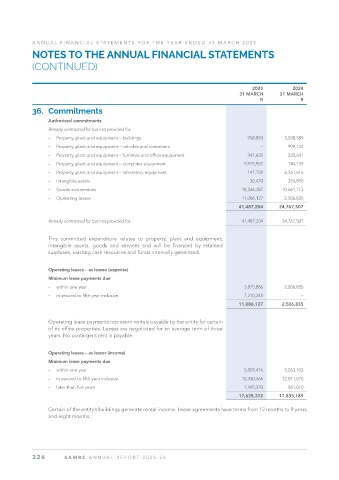

36. Commitments

Authorised commitments

Already contracted for but not provided for

– Property, plant and equipment – buildings 958,893 3,598,589

– Property, plant and equipment – vehicles and containers – 999,124

– Property, plant and equipment – furniture and office equipment 941,631 220,641

– Property, plant and equipment – computer equipment 9,975,937 144,139

– Property, plant and equipment – laboratory equipment 147,759 6,261,616

– Intangible assets 30,470 374,850

– Goods and services 18,346,387 10,661,713

– Operating leases 11,086,127 2,506,835

41,487,204 24,767,507

Already contracted for but not provided for 41,487,204 24,767,507

This committed expenditure relates to property, plant and equipment;

intangible assets; goods and services and will be financed by retained

surpluses, existing cash resources and funds internally generated.

Operating leases – as lessee (expense)

Minimum lease payments due

– within one year 3,875,886 2,506,835

– in second to fifth year inclusive 7,210,241 –

11,086,127 2,506,835

Operating lease payments represent rentals payable by the entity for certain

of its office properties. Leases are negotiated for an average term of three

years. No contingent rent is payable.

Operating leases – as lessor (income)

Minimum lease payments due

– within one year 5,859,476 5,263,103

– in second to fifth year inclusive 10,330,466 12,011,076

– later than five years 1,445,370 561,010

17,635,312 17,835,189

Certain of the entity’s buildings generate rental income. Lease agreements have terms from 12 months to 9 years

and eight months.

326 SAMRC ANNUAL REPOR T 2025-26