Page 322 - SAMRC Annual Report 2024-2025

P. 322

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

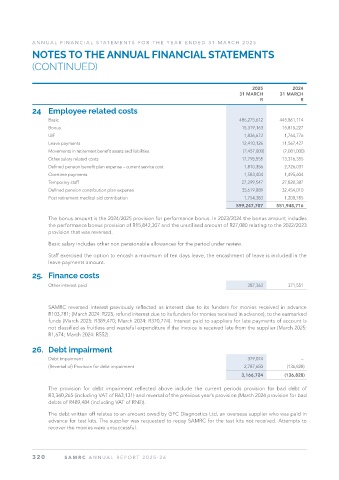

24 Employee related costs

Basic 486,275,612 445,861,114

Bonus 15,319,163 15,815,227

UIF 1,836,672 1,764,776

Leave payments 12,410,126 11,567,427

Movements in retirement benefit assets and liabilities (2,457,000) (2,081,000)

Other salary related costs 17,795,555 13,316,355

Defined pension benefit plan expense – current service cost 1,810,356 2,726,031

Overtime payments 1,583,404 1,495,604

Temporary staff 27,299,547 27,820,387

Defined pension contribution plan expense 35,619,889 32,454,010

Post retirement medical aid contribution 1,754,383 1,208,785

599,247,707 551,948,716

The bonus amount is the 2024/2025 provision for performance bonus. In 2023/2024 the bonus amount includes

the performance bonus provision of R15,842,307 and the unutilised amount of R27,080 relating to the 2022/2023

provision that was reversed.

Basic salary includes other non pensionable allowances for the period under review.

Staff exercised the option to encash a maximum of ten days leave, the encashment of leave is included in the

leave payments amount.

25. Finance costs

Other interest paid 287,363 371,551

SAMRC reversed interest previously reflected as interest due to its funders for monies received in advance

R103,781; (March 2024: R225, refund interest due to its funders for monies received in advance), to the earmarked

funds (March 2025: R389,470; March 2024: R370,774). Interest paid to suppliers for late payments of account is

not classified as fruitless and wasteful expenditure if the invoice is received late from the supplier (March 2025:

R1,674; March 2024: R552).

26. Debt impairment

Debt impairment 379,074 –

(Reversal of) Provision for debt impairment 2,787,650 (136,828)

3,166,724 (136,828)

The provision for debt impairment reflected above include the current periods provision for bad debt of

R3,340,265 (including VAT of R63,131) and reversal of the previous year’s provision (March 2024 provision for bad

debts of R489,484 (including VAT of RNil)).

The debt written off relates to an amount owed by GFC Diagnostics Ltd, an overseas supplier who was paid in

advance for test kits. The supplier was requested to repay SAMRC for the test kits not received. Attempts to

recover the monies were unsuccessful.

320 SAMRC ANNUAL REPOR T 2025-26