Page 326 - SAMRC Annual Report 2024-2025

P. 326

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

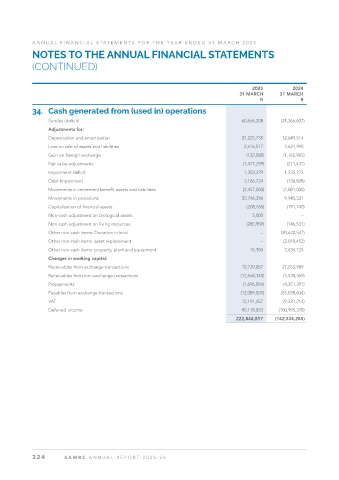

34. Cash generated from (used in) operations

Surplus (deficit) 60,666,208 (21,366,607)

Adjustments for:

Depreciation and amortisation 37,225,735 32,649,514

Loss on sale of assets and liabilities 2,616,517 3,621,990

Gain on foreign exchange (122,888) (1,162,965)

Fair value adjustments (1,477,299) (211,431)

Impairment deficit 1,353,329 1,235,223

Debt impairment 3,166,724 (136,828)

Movements in retirement benefit assets and liabilities (2,457,000) (2,081,000)

Movements in provisions 35,746,396 9,945,331

Capitalisation of financial assets (208,760) (191,740)

Non-cash adjustment on biological assets 5,000 –

Non-cash adjustment on living resources (280,959) (146,531)

Other non-cash items: Donation in kind – (20,622,547)

Other non-cash items: asset replacement – (2,010,452)

Other non-cash items: property, plant and equipment 16,150 3,634,725

Changes in working capital:

Receivables from exchange transactions 10,739,057 27,653,989

Receivables from non-exchange transactions (12,668,148) (3,538,369)

Prepayments (1,696,054) (4,351,391)

Payables from exchange transactions (12,089,501) (55,028,604)

VAT 12,191,457 (9,231,214)

Deferred income 90,118,853 (100,995,378)

222,844,817 (142,334,285)

324 SAMRC ANNUAL REPOR T 2025-26