Page 311 - SAMRC Annual Report 2024-2025

P. 311

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

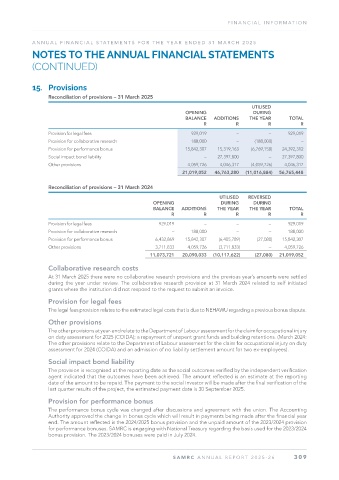

15. Provisions

Reconciliation of provisions – 31 March 2025

UTILISED

OPENING DURING

BALANCE ADDITIONS THE YEAR TOTAL

R R R R

Provision for legal fees 929,019 – – 929,019

Provision for collaborative research 188,000 – (188,000) –

Provision for performance bonus 15,842,307 15,319,163 (6,769,158) 24,392,312

Social impact bond liability – 27,397,800 – 27,397,800

Other provisions 4,059,726 4,046,317 (4,059,726) 4,046,317

21,019,052 46,763,280 (11,016,884) 56,765,448

Reconciliation of provisions – 31 March 2024

UTILISED REVERSED

OPENING DURING DURING

BALANCE ADDITIONS THE YEAR THE YEAR TOTAL

R R R R R

Provision for legal fees 929,019 – – – 929,019

Provision for collaborative research – 188,000 – – 188,000

Provision for performance bonus 6,432,869 15,842,307 (6,405,789) (27,080) 15,842,307

Other provisions 3,711,833 4,059,726 (3,711,833) – 4,059,726

11,073,721 20,090,033 (10,117,622) (27,080) 21,019,052

Collaborative research costs

At 31 March 2025 there were no collaborative research provisions and the previous year’s amounts were settled

during the year under review. The collaborative research provision at 31 March 2024 related to self initiated

grants where the institution did not respond to the request to submit an invoice.

Provision for legal fees

The legal fees provision relates to the estimated legal costs that is due to NEHAWU regarding a previous bonus dispute.

Other provisions

The other provisions at year-end relate to the Department of Labour assessment for the claim for occupational injury

on duty assessment for 2025 (COIDA); a repayment of unspent grant funds and building retentions. (March 2024:

The other provisions relate to the Department of Labour assessment for the claim for occupational injury on duty

assessment for 2024 (COIDA) and an admission of no liability settlement amount for two ex-employees).

Social impact bond liability

The provision is recognised at the reporting date as the social outcomes verified by the independent verification

agent indicated that the outcomes have been achieved. The amount reflected is an estimate at the reporting

date of the amount to be repaid. The payment to the social investor will be made after the final verification of the

last quarter results of the project, the estimated payment date is 30 September 2025.

Provision for performance bonus

The performance bonus cycle was changed after discussions and agreement with the union. The Accounting

Authority approved the change in bonus cycle which will result in payments being made after the financial year

end. The amount reflected is the 2024/2025 bonus provision and the unpaid amount of the 2023/2024 provision

for performance bonuses. SAMRC is engaging with National Treasury regarding the basis used for the 2023/2024

bonus provision. The 2023/2024 bonuses were paid in July 2024.

SAMRC ANNUAL REPOR T 2025-26 309