Page 314 - SAMRC Annual Report 2024-2025

P. 314

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

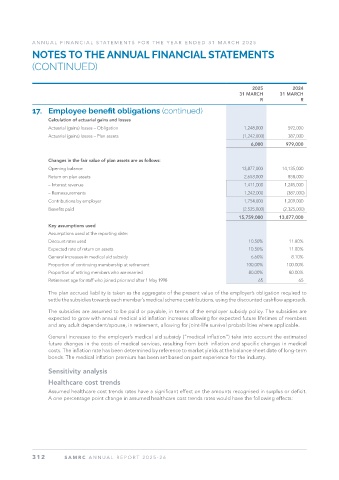

17. Employee benefit obligations (continued)

Calculation of actuarial gains and losses

Actuarial (gains) losses – Obligation 1,248,000 592,000

Actuarial (gains) losses – Plan assets (1,242,000) 387,000

6,000 979,000

Changes in the fair value of plan assets are as follows:

Opening balance 13,877,000 14,135,000

Return on plan assets 2,653,000 858,000

– Interest revenue 1,411,000 1,245,000

– Remeasurements 1,242,000 (387,000)

Contributions by employer 1,754,000 1,209,000

Benefits paid (2,525,000) (2,325,000)

15,759,000 13,877,000

Key assumptions used

Assumptions used at the reporting date:

Discount rates used 10.50% 11.80%

Expected rate of return on assets 10.50% 11.80%

General increases in medical aid subsidy 6.60% 8.10%

Proportion of continuing membership at retirement 100.00% 100.00%

Proportion of retiring members who are married 80.00% 80.00%

Retirement age for staff who joined prior and after 1 May 1998 65 65

The plan accrued liability is taken as the aggregate of the present value of the employer’s obligation required to

settle the subsidies towards each member’s medical scheme contributions, using the discounted cashflow approach.

The subsidies are assumed to be paid or payable, in terms of the employer subsidy policy. The subsidies are

expected to grow with annual medical aid inflation increases allowing for expected future lifetimes of members

and any adult dependent/spouse, in retirement, allowing for joint-life survival probabilities where applicable.

General increases to the employer’s medical aid subsidy (“medical inflation”) take into account the estimated

future changes in the costs of medical services, resulting from both inflation and specific changes in medical

costs. The inflation rate has been determined by reference to market yields at the balance sheet date of long-term

bonds. The medical inflation premium has been set based on past experience for the industry.

Sensitivity analysis

Healthcare cost trends

Assumed healthcare cost trends rates have a significant effect on the amounts recognised in surplus or deficit.

A one percentage point change in assumed healthcare cost trends rates would have the following effects:

312 SAMRC ANNUAL REPOR T 2025-26