Page 313 - SAMRC Annual Report 2024-2025

P. 313

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

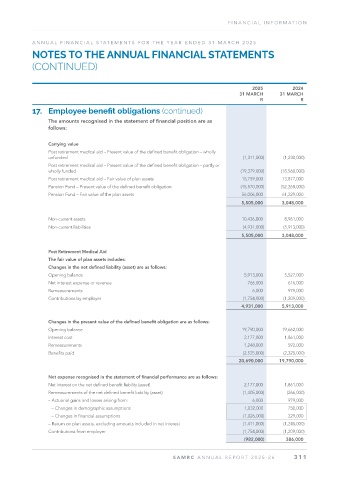

17. Employee benefit obligations (continued)

The amounts recognised in the statement of financial position are as

follows:

Carrying value

Post retirement medical aid – Present value of the defined benefit obligation – wholly

unfunded (1,311,000) (1,230,000)

Post retirement medical aid – Present value of the defined benefit obligation – partly or

wholly funded (19,379,000) (18,560,000)

Post retirement medical aid – Fair value of plan assets 15,759,000 13,877,000

Pension Fund – Present value of the defined benefit obligation (45,570,000) (52,268,000)

Pension Fund – Fair value of the plan assets 56,006,000 61,229,000

5,505,000 3,048,000

Non-current assets 10,436,000 8,961,000

Non-current liabilities (4,931,000) (5,913,000)

5,505,000 3,048,000

Post Retirement Medical Aid

The fair value of plan assets includes:

Changes in the net defined liability (asset) are as follows:

Opening balance 5,913,000 5,527,000

Net interest expense or revenue 766,000 616,000

Remeasurements 6,000 979,000

Contributions by employer (1,754,000) (1,209,000)

4,931,000 5,913,000

Changes in the present value of the defined benefit obligation are as follows:

Opening balance 19,790,000 19,662,000

Interest cost 2,177,000 1,861,000

Remeasurements 1,248,000 592,000

Benefits paid (2,525,000) (2,325,000)

20,690,000 19,790,000

Net expense recognised in the statement of financial performance are as follows:

Net interest on the net defined benefit liability (asset) 2,177,000 1,861,000

Remeasurements of the net defined benefit liability (asset) (1,405,000) (266,000)

– Actuarial gains and losses arising from: 6,000 979,000

– Changes in demographic assumptions 1,032,000 750,000

– Changes in financial assumptions (1,026,000) 229,000

– Return on plan assets, excluding amounts included in net interest (1,411,000) (1,245,000)

Contributions from employer (1,754,000) (1,209,000)

(982,000) 386,000

SAMRC ANNUAL REPOR T 2025-26 311