Page 315 - SAMRC Annual Report 2024-2025

P. 315

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

17. Employee benefit obligations (continued)

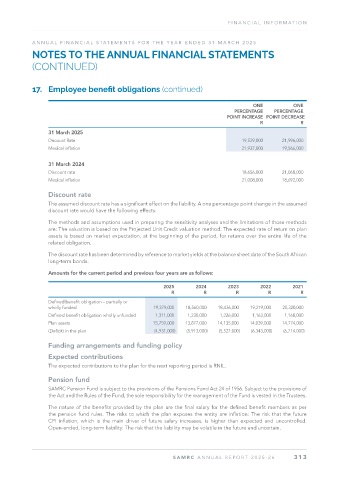

ONE ONE

PERCENTAGE PERCENTAGE

POINT INCREASE POINT DECREASE

R R

31 March 2025

Discount Rate 19,529,000 21,996,000

Medical inflation 21,937,000 19,566,000

31 March 2024

Discount rate 18,656,000 21,068,000

Medical inflation 21,008,000 18,692,000

Discount rate

The assumed discount rate has a significant effect on the liability. A one percentage point change in the assumed

discount rate would have the following effects:

The methods and assumptions used in preparing the sensitivity analyses and the limitations of those methods

are: The valuation is based on the Projected Unit Credit valuation method. The expected rate of return on plan

assets is based on market expectation, at the beginning of the period, for returns over the entire life of the

related obligation.

The discount rate has been determined by reference to market yields at the balance sheet date of the South African

long-term bonds.

Amounts for the current period and previous four years are as follows:

2025 2024 2023 2022 2021

R R R R R

Defined benefit obligation – partially or

wholly funded 19,379,000 18,560,000 18,436,000 19,219,000 20,320,000

Defined benefit obligation wholly unfunded 1,311,000 1,230,000 1,226,000 1,163,000 1,168,000

Plan assets 15,759,000 13,877,000 14,135,000 14,039,000 14,774,000

(Deficit) in the plan (4,931,000) (5,913,000) (5,527,000) (6,343,000) (6,714,000)

Funding arrangements and funding policy

Expected contributions

The expected contributions to the plan for the next reporting period is RNIL.

Pension fund

SAMRC Pension Fund is subject to the provisions of the Pensions Fund Act 24 of 1956. Subject to the provisions of

the Act and the Rules of the Fund, the sole responsibility for the management of the Fund is vested in the Trustees.

The nature of the benefits provided by the plan are the final salary for the defined benefit members as per

the pension fund rules. The risks to which the plan exposes the entity are inflation: The risk that the future

CPI inflation, which is the main driver of future salary increases, is higher than expected and uncontrolled.

Open-ended, long-term liability: The risk that the liability may be volatile in the future and uncertain.

SAMRC ANNUAL REPOR T 2025-26 313