Page 312 - SAMRC Annual Report 2024-2025

P. 312

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

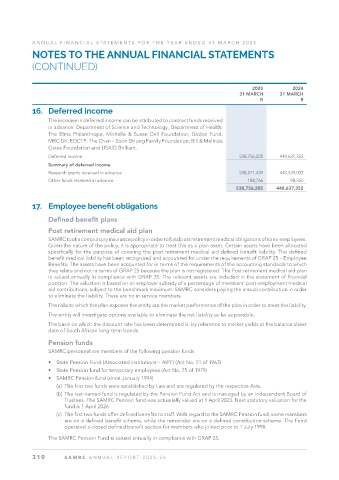

16. Deferred income

The increase in deferred income can be attributed to contract funds received

in advance: Department of Science and Technology; Department of Health;

The Elma Philanthrope; Michelle & Susan Dell Foundation; Global Fund;

MRC UK; EDCTP; The Chan – Soon Shiong Family Foundation; Bill & Melinda

Gates Foundation and USAID Brilliant.

Deferred income 538,756,205 448,637,352

Summary of deferred income

Research grants received in advance 538,571,439 448,539,002

Other funds received in advance 184,766 98,350

538,756,205 448,637,352

17. Employee benefit obligations

Defined benefit plans

Post retirement medical aid plan

SAMRC took a compulsory insurance policy in order to fund post retirement medical obligations of its ex-employees.

Given the nature of the policy, it is appropriate to treat this as a plan asset. Certain assets have been allocated

specifically for the purpose of covering the post retirement medical aid defined benefit liability. The defined

benefit medical liability has been recognised and accounted for under the requirements of GRAP 25 – Employee

Benefits. The assets have been accounted for in terms of the requirements of the accounting standards to which

they relate and not in terms of GRAP 25 because the plan is not registered. The Post retirement medical aid plan

is valued annually in compliance with GRAP 25. The relevant assets are included in the statement of financial

position. The valuation is based on an employer subsidy of a percentage of members’ post-employment medical

aid contributions, subject to the benchmark maximum. SAMRC considers paying the annual contribution in order

to eliminate the liability. There are no in service members.

The risks to which the plan exposes the entity are the market performance of the plan in order to meet the liability.

The entity will investigate options available to eliminate the net liability as far as possible.

The basis on which the discount rate has been determined is: by reference to market yields at the balance sheet

date of South African long-term bonds.

Pension funds

SAMRC personnel are members of the following pension funds

• State Pension Fund (Associated institutions – AIPF) (Act No. 51 of 1963)

• State Pension fund for temporary employees (Act No. 75 of 1979)

• SAMRC Pension fund (since January 1994)

(a) The first two funds were established by Law and are regulated by the respective Acts.

(b) The last-named fund is regulated by the Pension Fund Act and is managed by an independent Board of

Trustees. The SAMRC Pension fund was actuarially valued at 1 April 2023. Next statutory valuation for the

fund is 1 April 2026.

(c) The first two funds offer defined benefits to staff. With regard to the SAMRC Pension fund, some members

are on a defined benefit scheme, while the remainder are on a defined contribution scheme. The Fund

operated a closed defined benefit section for members who joined prior to 1 July 1998.

The SAMRC Pension Fund is valued annually in compliance with GRAP 25.

310 SAMRC ANNUAL REPOR T 2025-26