Page 319 - SAMRC Annual Report 2024-2025

P. 319

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

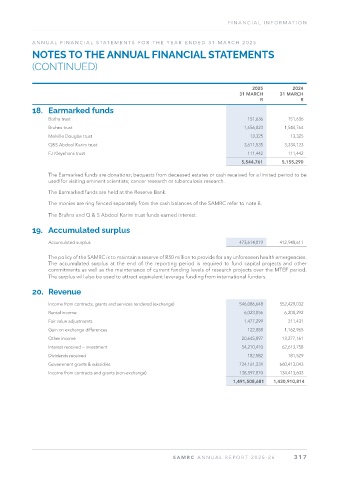

18. Earmarked funds

Botha trust 151,636 151,636

Bruhns trust 1,656,823 1,544,764

Melville Douglas trust 13,325 13,325

Q&S Abdool Karim trust 3,611,535 3,334,123

FJ Kleynhans trust 111,442 111,442

5,544,761 5,155,290

The Earmarked funds are donations; bequests from deceased estates or cash received for a limited period to be

used for visiting eminent scientists; cancer research or tuberculosis research.

The Earmarked funds are held at the Reserve Bank.

The monies are ring fenced separately from the cash balances of the SAMRC refer to note 8.

The Bruhns and Q & S Abdool Karim trust funds earned interest.

19. Accumulated surplus

Accumulated surplus 473,614,819 412,948,611

The policy of the SAMRC is to maintain a reserve of R50 million to provide for any unforeseen health emergencies.

The accumulated surplus at the end of the reporting period is required to fund capital projects and other

commitments as well as the maintenance of current funding levels of research projects over the MTEF period.

The surplus will also be used to attract equivalent leverage funding from international funders.

20. Revenue

Income from contracts, grants and services rendered (exchange) 546,086,648 552,429,032

Rental income 6,023,856 6,208,292

Fair value adjustments 1,477,299 211,431

Gain on exchange differences 122,888 1,162,965

Other income 20,645,897 13,277,161

Interest received – investment 54,210,410 62,613,758

Dividends received 182,582 181,529

Government grants & subsidies 724,161,231 660,413,043

Income from contracts and grants (non-exchange) 138,597,870 134,413,603

1,491,508,681 1,430,910,814

SAMRC ANNUAL REPOR T 2025-26 317