Page 317 - SAMRC Annual Report 2024-2025

P. 317

FINANCIAL INFORMATION

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

2025 2024

31 MARCH 31 MARCH

R R

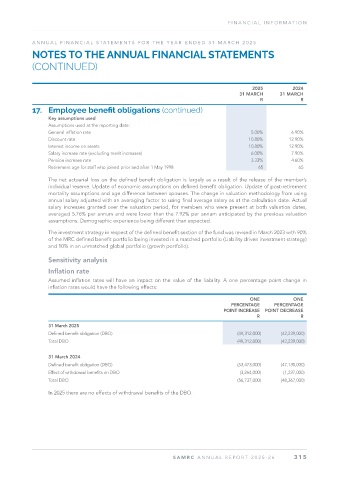

17. Employee benefit obligations (continued)

Key assumptions used

Assumptions used at the reporting date:

General inflation rate 5.00% 6.90%

Discount rate 10.80% 12.90%

Interest income on assets 10.80% 12.90%

Salary increase rate (excluding merit increases) 6.00% 7.90%

Pension increase rate 3.33% 4.60%

Retirement age for staff who joined prior and after 1 May 1998 65 65

The net actuarial loss on the defined benefit obligation is largely as a result of the release of the member’s

individual reserve. Update of economic assumptions on defined benefit obligation. Update of post-retirement

mortality assumptions and age difference between spouses. The change in valuation methodology from using

annual salary adjusted with an averaging factor to using final average salary as at the calculation date. Actual

salary increases granted over the valuation period, for members who were present at both valuation dates,

averaged 5.76% per annum and were lower than the 7.92% per annum anticipated by the previous valuation

assumptions. Demographic experience being different than expected.

The investment strategy in respect of the defined benefit section of the fund was revised in March 2023 with 90%

of the MRC defined benefit portfolio being invested in a matched portfolio (Liability driven investment strategy)

and 10% in an unmatched global portfolio (growth portfolio).

Sensitivity analysis

Inflation rate

Assumed inflation rates will have an impact on the value of the liability. A one percentage point change in

inflation rates would have the following effects:

ONE ONE

PERCENTAGE PERCENTAGE

POINT INCREASE POINT DECREASE

R R

31 March 2025

Defined benefit obligation (DBO) (49,312,000) (42,239,000)

Total DBO (49,312,000) (42,239,000)

31 March 2024

Defined benefit obligation (DBO) (53,473,000) (47,130,000)

Effect of withdrawal benefits on DBO (3,264,000) (1,237,000)

Total DBO (56,737,000) (48,367,000)

In 2025 there are no effects of withdrawal benefits of the DBO.

SAMRC ANNUAL REPOR T 2025-26 315