Page 318 - SAMRC Annual Report 2024-2025

P. 318

ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2025

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

(CONTINUED)

17 Employee benefit obligations (continued)

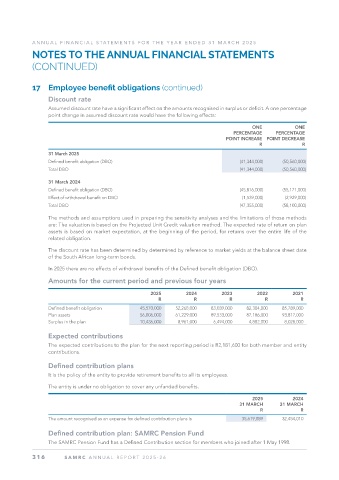

Discount rate

Assumed discount rate have a significant effect on the amounts recognised in surplus or deficit. A one percentage

point change in assumed discount rate would have the following effects:

ONE ONE

PERCENTAGE PERCENTAGE

POINT INCREASE POINT DECREASE

R R

31 March 2025

Defined benefit obligation (DBO) (41,344,000) (50,560,000)

Total DBO (41,344,000) (50,560,000)

31 March 2024

Defined benefit obligation (DBO) (45,816,000) (55,171,000)

Effect of withdrawal benefit on DBO (1,539,000) (2,929,000)

Total DBO (47,355,000) (58,100,000)

The methods and assumptions used in preparing the sensitivity analyses and the limitations of those methods

are: The valuation is based on the Projected Unit Credit valuation method. The expected rate of return on plan

assets is based on market expectation, at the beginning of the period, for returns over the entire life of the

related obligation.

The discount rate has been determined by determined by reference to market yields at the balance sheet date

of the South African long-term bonds.

In 2025 there are no effects of withdrawal benefits of the Defined benefit obligation (DBO).

Amounts for the current period and previous four years

2025 2024 2023 2022 2021

R R R R R

Defined benefit obligation 45,570,000 52,268,000 83,039,000 82,304,000 85,789,000

Plan assets 56,006,000 61,229,000 89,533,000 87,186,000 93,817,000

Surplus in the plan 10,436,000 8,961,000 6,494,000 4,882,000 8,028,000

Expected contributions

The expected contributions to the plan for the next reporting period is R2,181,600 for both member and entity

contributions.

Defined contribution plans

It is the policy of the entity to provide retirement benefits to all its employees.

The entity is under no obligation to cover any unfunded benefits.

2025 2024

31 MARCH 31 MARCH

R R

The amount recognised as an expense for defined contribution plans is 35,619,889 32,454,010

Defined contribution plan: SAMRC Pension Fund

The SAMRC Pension Fund has a Defined Contribution section for members who joined after 1 May 1998.

316 SAMRC ANNUAL REPOR T 2025-26